Can you imagine losing 8% of your profit in the blink of an eye? That’s the potential impact of not protecting your foreign currency exposure.

From January 2022 to July 2022, we’ve seen the USD fall from a high of 1.37 to 1.18, a whopping 14% decline. After surviving the worst two years of trading in recent history, the travel industry’s had lots on its plate. Just when you’re getting back on your feet, you don’t want another setback. Now is an excellent time to evaluate your currency risk.

What does currency risk look like?

It can take different forms depending on which countries you operate in. For a typical UK-based tour operator, the transactional risk is the most visible and actively managed.

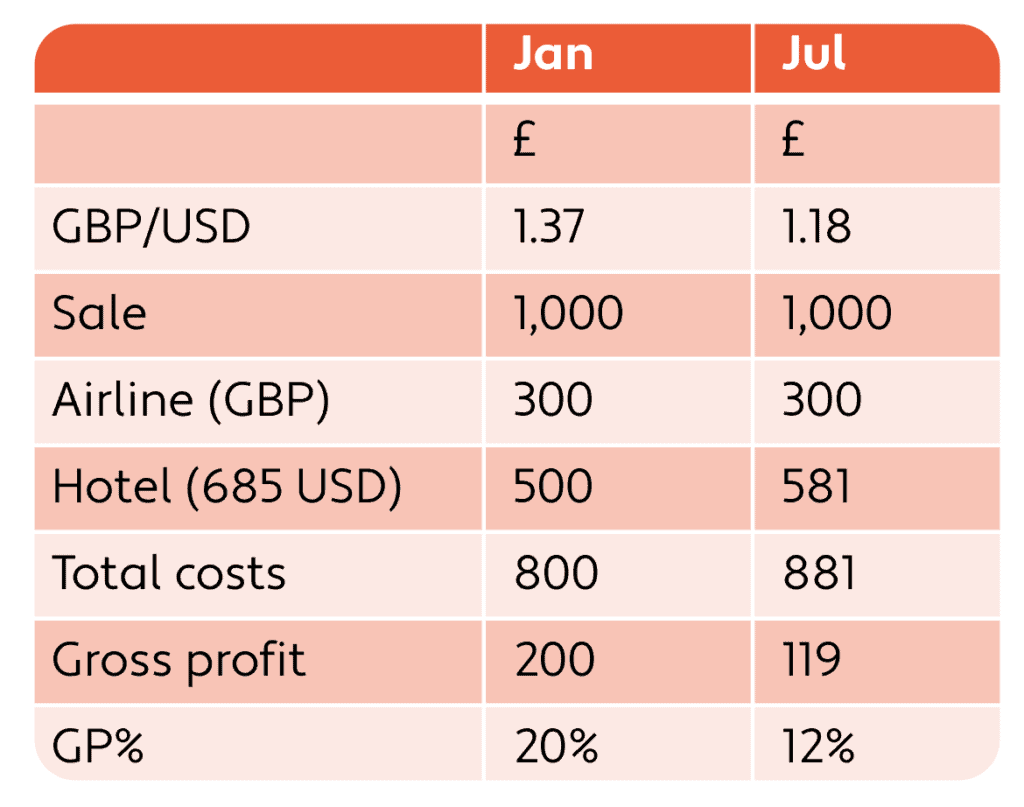

Here’s an example: You take a booking from a customer in January when the GBP/USD rate is 1.37, and your systems are set at this rate accordingly. The supplier payable in USD is not due to be paid until July, much closer to departure. With everything else being equal, you stand to make £200 gross profit on the booking (see below).

You don’t protect the exposure to USD. When it comes to paying your invoice, the cost to you in GBP is now £581 instead of £500. Now your £200 gross profit is £119.

What if you buy currency now, but it fluctuates in the future?

No one knows what will happen. For example, there’s speculation the USD will continue to gain strength with the current economic backdrop. However, there are many factors that come into play, so it’s very difficult to predict what might happen.

Your aim should be to protect what you have rather than try and guess the markets.

4 tips for protecting your bottom line from currency volatility

1 – Understand your exposure

It is essential to understand what you’re dealing with. Look at whether you just have transactional exposure for outgoing cashflows i.e paying suppliers. Or if you receive any foreign currency which could be used to pay suppliers.

What currencies are you dealing with, and what is the time horizon of the exposure?

2 – Decide on your risk appetite

There are certain factors to consider here. For example, cancellations and amendments are still causing operational issues for tour operators, which means the foreign currency risk either ceases to exist or gets pushed further down the road.

Leave headroom for cancellations and amendments. Typically, the risk appetite will be expressed as a target cover ratio. For example, protecting 90% of your exposure will leave some potential upside while limiting the downside.

Your appetite will change depending on your business type and where you are within a cycle, so it’s key you review this frequently. For example, because of the long-time horizon, you’ll want to protect departures 12 months away as much as possible. However, as a season approaches and you enter a last-minute booking market, you might be more confident not covering all of the exposure.

3 – Work out how you’ll protect the risk

There are various options for protecting against risk. From basic financial instruments (forward contracts) to more complicated methods. Ensure you have the right advisors who understand what you need.

4 – Give yourself a head start

When making payments to suppliers, you won’t achieve the market rate as you’re unlikely to be booking currency protection each day. Therefore, we recommend pricing products with a 2-3% margin to allow for some protection while remaining competitive.

Now that the challenges of the pandemic are easing off, it’s time to look at your currency exposure. If you’re unsure how to choose an FX provider, here are our top tips for making the right decision.

If you feel exposed and need help with protecting your margins, please get in touch.

Join our newsletter

If you enjoyed this post, why not sign up to our newsletter? Get our latest blog posts, industry updates and exclusive content.

Sign up